As electric vehicle technology gains ground in the realm of passenger cars and trucks, it’s also reshaping the landscape of two-wheeled transportation.

The future of automotive technology will embrace a diverse range of power sources, with electric power set to be a pivotal player. Currently, this shift is most evident in the four-wheeled segment, marked by a surge in sales of battery electric vehicles and fuel cell electric vehicles.

The electrification wave is poised to revolutionize the world of two-wheelers, encompassing mopeds, scooters, motorbikes, and motorcycles—a category that accounts for approximately 30% of global transportation.

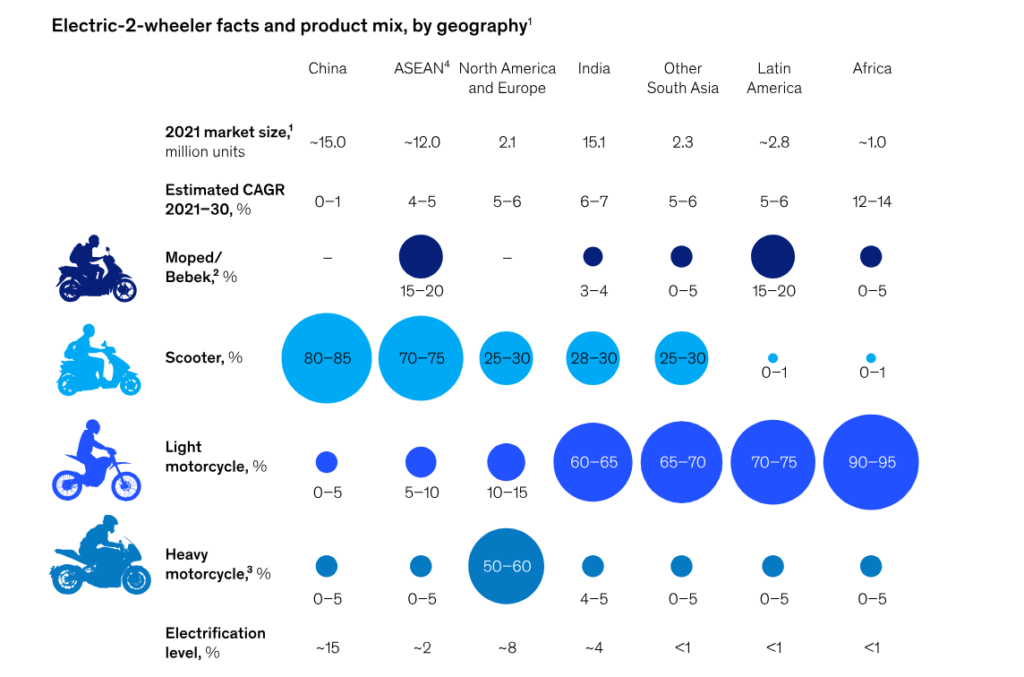

This transformation is particularly significant in regions like China, South Asia, and Southeast Asia, where they sold approximately 45 million units in fiscal year 2021, highlighting their essential role in the transportation network.

Currently, the electric conversion of two-wheelers represents a minor share, but the market has seen a surge in new entrants. Just like their four-wheeled counterparts, the electric transformation of these vehicles holds the potential to gain significant momentum, contributing to emissions reduction.

In our comprehensive analysis, we delve deep into the electric two-wheeler market, examining its growth trends, total cost of ownership (TCO), recent technological advancements, and consumer perceptions. Armed with these valuable insights, we identify key success factors for original equipment manufacturers (OEMs) and other stakeholders in the two-wheeler industry.

Global Two-Wheeler Market

This transformation is particularly significant in regions like China, South Asia, and Southeast Asia, where they sold approximately 45 million units in fiscal year 2021, highlighting their essential role in the transportation network. For instance, in India, electric two-wheelers accounted for just 4 percent of total sales in 2021. Nevertheless, on a global scale, our projections suggest that by 2030, electric two-wheelers will make up approximately 30 percent of the market.

In China and the developing world, the focus remains on smaller, utility-oriented machines for work and transportation purposes. Meanwhile, in North America (excluding Mexico) and Europe, the landscape is more diverse. Here, premium brands dominate the market, offering products with engine capacities exceeding 500 cubic centimeters. High-end, high-performance motorcycles extend into heavyweight and superheavyweight categories, attracting consumers for recreation and sports.

Newcomers, eyeing potential market opportunities in these lucrative segments, have been driving innovation in electric motorcycles. Nevertheless, challenges such as cost premiums, battery chemistry-related range limitations, and a lack of economies of scale remain significant obstacles in convincing dedicated high-performance and long-distance riders.

The limited adoption of electric two-wheelers holds significant implications for addressing climate change. In regions where these vehicles are the primary mode of transportation, they consume over 50 percent of gasoline and contribute to 5 to 10 percent of CO2 emissions. As more countries aim for net-zero emissions and fight urban pollution, the need to shift to electric two-wheelers grows more urgent.

Drawing insights from the evolution of the four-wheeled vehicle market, government regulations advocating for electric two-wheelers could trigger substantial change and potentially boost sales. For instance, China leads the world in electric vehicle (EV) adoption rates, largely due to robust government support for electrification initiatives.

Surging Consumer Demand for Electric Two-Wheelers

Historically, electrification in the major two-wheeler markets has languished below the 5 percent mark, primarily due to a host of barriers. These obstacles encompass elevated upfront expenses, performance disparities when compared to internal-combustion-engine (ICE) counterparts, a dearth of diverse product offerings from established players, and the absence of comprehensive financing and charging infrastructures.

However, it’s important to note that the landscape is on the brink of transformation, as substantial efforts are underway to tackle these challenges head-on.

Notable advancements in battery technology have eliminated the constraints of limited range concerns for electric two-wheelers. Presently, lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) batteries boast energy densities of approximately 180 to 250 Wh/kg, offering an impressive range of 80 to 120 kilometers per charge.

Furthermore, the total cost of ownership (TCO) for electric two-wheelers already rivals that of internal combustion engine (ICE) vehicles in many regions, and they are poised to become even more cost-effective than ICE alternatives.

Traditionally, battery costs have represented around 35 percent of the total bill of materials (BOM) for two-wheelers. However, these costs are experiencing significant declines as manufacturers achieve economies of scale, streamline production processes, and shift towards more cost-efficient LFP batteries.

Electric two-wheelers are enjoying a favorable regulatory environment, including consumer subsidies of up to 25 percent of their purchase price. Rising oil prices and the gradual reduction of traditional fossil fuel subsidies in various countries further contribute to their appeal. In countries like Indonesia, the TCO for locally assembled electric two-wheelers has already reached breakeven and will become even more budget-friendly as the electric vehicle industry continues to mature.

Electric Two-Wheelers: A Growing Focus for the Investment Community

Between 2018 and 2022, investments in the micro mobility sector have surged to over $8 billion. While the number of transactions has decreased due to COVID-19-induced market volatility, the median deal size has quadrupled, growing from $1 million in 2018 to $4.23 million in 2022.

Historically, investors predominantly channeled these funds into low-speed electric two-wheelers like kick scooters, mopeds, and bicycles. However, high-speed scooters are now also drawing substantial investments from private equity, venture capital funds, and smart-mobility service providers. As an illustration, a company primarily focused on two-wheelers in India raised over $1.5 billion in 2022.

Lead the Way

OEMs operating in the electric two-wheeler market can tap into the valuable insights of early adopter customers. With consent-backed access to rider and bike data, manufacturers can unlock a plethora of opportunities for product and service enhancements.

For instance, integrated electronic systems can effortlessly transmit vehicle and rider data, refining product features, enhancing efficiency, and optimizing maintenance.

Furthermore, OEMs can implement automated software updates and upgrades to provide riders with enhanced performance and convenient new features. In an innovative approach, a premium electric two-wheeler company has ventured into a peer-to-peer blockchain-enabled bike-sharing customer experience.

This initiative enables bike owners to securely share their vehicles with other riders, for free or in exchange for cryptocurrency payments, ensuring an integrated customer experience.

Conclusion

The electric two-wheeler market is at a pivotal juncture, poised for significant growth and transformation. Electric two-wheelers provide an attractive, sustainable option, reducing emissions and enhancing urban mobility amid the search for eco-friendly transportation.

With advancements in battery technology, these vehicles are overcoming range limitations, making them increasingly practical and cost-effective.

vurcazkircazpatliycaz.kHWXlspJbcT6

parabolizes xyandanxvurulmus.bwQ6MSjP7WDV

pornhub bahis siteleri footballxx.97oAiL679fek

porno mobileidn.2QnbDeSCgkef

goodhere Big Ass porn vurucutewet.RKuRMQPAnpG

स्विंगर पोर्न है txechdyzxca.B58SdVUrfco

मिशनरी शैली की अश्लीलता hkyonet.GkUtrVw0dXy

ਕਮ ਸ਼ਾਟ ਪੋਰਨ madisonivysex.FpFVkBsncrr

ladesbet ਈਬੋਨੀ ਪੋਰਨ ladesinemi.25aUCHx36E6

ladesbet 漫画ポルノ ladestinemi.gkiYM31NRAm

Appreciate it for helping out, superb info .

can you buy azithromycin over the counter uk

I’d always want to be update on new content on this site, saved to favorites! .

I like examining and I think this website got some genuinely useful stuff on it! .

Tonic Greens: An Overview. Introducing Tonic Greens, an innovative immune support supplement

What Is ErecPrime? ErecPrime is a male enhancement supplement that will help with improving one’s sexual experience.

Well I really enjoyed studying it. This information offered by you is very practical for accurate planning.

Lottery Defeater Software is a fully automated, plug-and-play system designed to significantly improve your chances of winning the lottery.

I am now not positive the place you’re getting your information, but good topic. I needs to spend some time studying much more or figuring out more. Thanks for excellent information I was searching for this information for my mission.

I¦ve read a few excellent stuff here. Definitely value bookmarking for revisiting. I wonder how much effort you set to create this kind of fantastic informative site.

Its excellent as your other content : D, appreciate it for putting up. “Talent does what it can genius does what it must.” by Edward George Bulwer-Lytton.

It¦s really a cool and helpful piece of info. I am glad that you simply shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

It’s really a cool and helpful piece of info. I am glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

Very interesting info !Perfect just what I was searching for! “It’s not the having, its the getting.” by Elizabeth Taylor.

You have brought up a very superb points, thankyou for the post.

I couldn’t resist commenting

There are some attention-grabbing deadlines on this article but I don’t know if I see all of them center to heart. There’s some validity however I’ll take hold opinion until I look into it further. Good article , thanks and we wish more! Added to FeedBurner as properly

I am continually looking online for posts that can facilitate me. Thank you!

Some truly interesting points you have written.Helped me a lot, just what I was searching for : D.

Thank you for another great article. The place else may anybody get that type of information in such an ideal way of writing? I have a presentation subsequent week, and I’m on the search for such info.

Very wonderful info can be found on website.

I appreciate, cause I found just what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a great day. Bye

Very nice article and straight to the point. I am not sure if this is actually the best place to ask but do you folks have any thoughts on where to get some professional writers? Thank you 🙂

There is clearly a bundle to identify about this. I believe you made some good points in features also.

Great post. I used to be checking constantly this weblog and I’m impressed! Extremely helpful information specially the closing phase 🙂 I maintain such information a lot. I used to be seeking this certain info for a very lengthy time. Thank you and best of luck.

Deference to op, some wonderful entropy.

Wonderful work! This is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my web site . Thanks =)

Hey there! Do you use Twitter? I’d like to follow you if that would be okay. I’m undoubtedly enjoying your blog and look forward to new updates.

ремонт смартфонов в москве

Профессиональный сервисный центр по ремонту ноутбуков, макбуков и другой компьютерной техники.

Мы предлагаем:ремонт macbook в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

ремонт матрицы телевизора

Профессиональный сервисный центр по ремонту сотовых телефонов, смартфонов и мобильных устройств.

Мы предлагаем: ремонт телефонов по близости

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту сотовых телефонов, смартфонов и мобильных устройств.

Мы предлагаем: ремонт сотовых телефонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту квадрокоптеров и радиоуправляемых дронов.

Мы предлагаем:ремонт квадрокоптеров в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков, imac и другой компьютерной техники.

Мы предлагаем:ремонт imac выезд

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту ноутбуков и компьютеров.дронов.

Мы предлагаем:срочный ремонт ноутбуков в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

мастерская apple в москве

Excellent site. Lots of useful info here. I am sending it to several friends ans also sharing in delicious. And obviously, thanks for your effort!

ремонт apple watch

Наши специалисты предлагает высококачественный сервис ремонта фотоаппаратов на выезде различных марок и моделей. Мы понимаем, насколько важны для вас ваши камеры, и обеспечиваем ремонт наилучшего качества. Наши квалифицированные специалисты оперативно и тщательно выполняют работу, используя только качественные детали, что предоставляет длительную работу выполненных работ.

Наиболее общие проблемы, с которыми сталкиваются владельцы фотоаппаратов, включают повреждения линз, неисправности затвора, поврежденный дисплей, проблемы с питанием и неисправности программного обеспечения. Для устранения этих проблем наши квалифицированные специалисты проводят ремонт объективов, затворов, экранов, батарей и ПО. Доверив ремонт нам, вы получаете долговечный и надежный ремонт фотоаппаратов адреса.

Подробная информация доступна на сайте: https://remont-fotoapparatov-ink.ru

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры по ремонту техники в спб

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту планетов в том числе Apple iPad.

Мы предлагаем: ремонт ipad в москве на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи москва

Если вы искали где отремонтировать сломаную технику, обратите внимание – сервис центр в петербурге

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в екб

ремонт телевизоров

Наши специалисты предлагает высококачественный ремонт стиральных машин с гарантией всех типов и брендов. Мы понимаем, насколько значимы для вас ваши автоматические стиральные машины, и стремимся предоставить услуги наилучшего качества. Наши профессиональные техники работают быстро и аккуратно, используя только сертифицированные компоненты, что обеспечивает долговечность и надежность наших услуг.

Наиболее распространенные поломки, с которыми сталкиваются обладатели устройств для стирки, включают неработающий барабан, неработающий нагревательный элемент, ошибки ПО, неработающий насос и повреждения корпуса. Для устранения этих неисправностей наши профессиональные техники проводят ремонт барабанов, нагревательных элементов, ПО, насосов и механических компонентов. Обращаясь в наш сервисный центр, вы гарантируете себе надежный и долговечный сервисный центр по ремонту стиральных машин адреса.

Подробная информация доступна на сайте: https://remont-stiralnyh-mashin-ace.ru

Если вы искали где отремонтировать сломаную технику, обратите внимание – выездной ремонт бытовой техники в москве

Профессиональный сервисный центр по ремонту Apple iPhone в Москве.

Мы предлагаем: качественный ремонт айфонов в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

сервис по ремонту смартфонов

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту источников бесперебойного питания.

Мы предлагаем: сервисный центр по ремонту ибп

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

I have read some good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to make such a fantastic informative website.

Если вы искали где отремонтировать сломаную технику, обратите внимание – тех профи

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт крупногабаритной техники в екатеринбурге

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту варочных панелей и индукционных плит.

Мы предлагаем: ремонт электрических панели

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

починить фотоаппарат

https://www.heritagefamilypantry.com/dRJXJ0ZgAnp

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в челябинске

Используйте промокоды на https://888starz.today и увеличьте свой шанс на крупные выигрыши.

Профессиональный сервисный центр по ремонту фото техники от зеркальных до цифровых фотоаппаратов.

Мы предлагаем: ремонт фототехники

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту фото техники от зеркальных до цифровых фотоаппаратов.

Мы предлагаем: ремонт проекторов на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту планшетов в Москве.

Мы предлагаем: стоимость замены экрана на планшете

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи услуги

Приложение для Android от 888Starz доступно для скачивания и игры на ходу https://ujkh.ru/forum.php?PAGE_NAME=profile_view&UID=117260

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры в новосибирске

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в казани

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт бытовой техники в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту видео техники а именно видеокамер.

Мы предлагаем: ремонт цифровых видеокамер

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – выездной ремонт бытовой техники в красноярске

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту стиральных машин с выездом на дом по Москве.

Мы предлагаем: срочный ремонт стиральных машин в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт бытовой техники в казани

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт техники в перми

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – сервисный центр в ростове на дону

Профессиональный сервисный центр по ремонту игровых консолей Sony Playstation, Xbox, PSP Vita с выездом на дом по Москве.

Мы предлагаем: ремонт консолей

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту компьютерных видеокарт по Москве.

Мы предлагаем: починка видеокарты

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту фототехники в Москве.

Мы предлагаем: вызвать мастера по ремонту фотовспышек

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Подробнее на сайте сервисного центра remont-vspyshek-realm.ru

Профессиональный сервисный центр по ремонту компьютероной техники в Москве.

Мы предлагаем: ремонт стационарных компьютеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту фото техники от зеркальных до цифровых фотоаппаратов.

Мы предлагаем: проектор ремонт

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Наткнулся на замечательный интернет-магазин, специализирующийся на раковинах и ваннах. Решил сделать ремонт в ванной комнате и искал качественную сантехнику по разумным ценам. В этом магазине нашёл всё, что нужно. Большой выбор раковин и ванн различных типов и дизайнов.

Особенно понравилось, что они предлагают раковина в ванную комнату купить в москве. Цены доступные, а качество продукции отличное. Консультанты очень помогли с выбором, были вежливы и профессиональны. Доставка была оперативной, и установка прошла без нареканий. Очень доволен покупкой и сервисом, рекомендую!

Профессиональный сервисный центр по ремонту компьютерных блоков питания в Москве.

Мы предлагаем: ремонт блоков питания москва

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

<a href=”https://remont-kondicionerov-wik.ru”>надежный сервис ремонта кондиционеров</a>

Мой телефон перестал заряжаться, и я не знал, что делать. По совету друга обратился в этот сервисный центр. Мастера быстро нашли проблему и устранили её. Теперь мой телефон снова в строю! Рекомендую всем: круглосуточный ремонт телефонов москва.

сервис профи самара

Профессиональный сервисный центр по ремонту компьютероной техники в Москве.

Мы предлагаем: ремонт компьютеров на дому в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту камер видео наблюдения по Москве.

Мы предлагаем: ремонт систем видеонаблюдения

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в нижнем новгороде

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кнаручных часов от советских до швейцарских в Москве.

Мы предлагаем: срочный ремонт часов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в перми

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

профессиональный ремонт кондиционеров

Профессиональный сервисный центр по ремонту парогенераторов в Москве.

Мы предлагаем: профессиональный ремонт парогенераторов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Какие законы регулируют деятельность полигонов ТБО в Новосибирской области https://novosibirsk-news.net/other/2024/06/02/281182.html

Зарегистрируйтесь и получите фрибеты на https://888starz.today

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в волгограде

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в красноярске

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи услуги

What’s Happening i am new to this, I stumbled upon this I’ve discovered It positively useful and it has aided me out loads. I am hoping to contribute & assist different customers like its helped me. Great job.

http://agrocolleg.ru/media/pgs/?effekt_zeygarnik_sekret_zapominaniya_nezavershennyh_del.html

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:сервисные центры по ремонту техники в ростове на дону

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сервисный центр предлагает ремонт духовых шкафов maunfeld недорого центр ремонта духового шкафа maunfeld

сервисный центре предлагает ремонт телевизоров недорого – ремонт телевизора

Сервисный центр предлагает мастерские ремонта планшетов roverpad выездной ремонт планшетов roverpad

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники

Профессиональный сервисный центр по ремонту компьютеров и ноутбуков в Москве.

Мы предлагаем: ремонт макбука

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры в тюмени

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кофемашин по Москве.

Мы предлагаем: ремонт кофемашин москва выезд

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту кондиционеров в Москве.

Мы предлагаем: срочный ремонт кондиционера

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту гироскутеров в Москве.

Мы предлагаем: сервис гироскутеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту моноблоков в Москве.

Мы предлагаем: ремонт экрана моноблока

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту планшетов в том числе Apple iPad.

Мы предлагаем: ремонт айпада

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту посудомоечных машин с выездом на дом в Москве.

Мы предлагаем: ремонт посудомоечной машины в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сервисный центр предлагает качественный ремонт телефонов google сколько стоит ремонт телефона google

Профессиональный сервисный центр по ремонту МФУ в Москве.

Мы предлагаем: сервис мфу в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту принтеров в Москве.

Мы предлагаем: срочный ремонт принтера с выездом

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт крупногабаритной техники в уфе

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту плоттеров в Москве.

Мы предлагаем: цены на ремонт плоттеров

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту объективов в Москве.

Мы предлагаем: цены на ремонт объективов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту серверов в Москве.

Мы предлагаем: срочный ремонт компьютеров на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сервисный центр предлагает замена экрана lg optimus f5 4g lte p875 поменть стекло lg optimus f5 4g lte p875

http://xn—-ytbeatdi.xn--b1aebbi9aie.xn--p1ai/nat/pages/?kalendary_pokupok_kogda_i_kak_pokupaty_odeghdu.html

Профессиональный сервисный центр по ремонту сетевых хранилищ в Москве.

Мы предлагаем: ремонт сетевых хранилищ на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту сигвеев в Москве.

Мы предлагаем: сигвей ремонт в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту автомагнитол в Москве.

Мы предлагаем: ремонт автомагнитол

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр по ремонту планшетов в Москве.

Мы предлагаем: сколько стоит заменить стекло на планшете самсунг

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

вывод из запоя цены ростов на дону vyvod-iz-zapoya-rostov15.ru .

вывод из запоя цены ростов на дону http://www.vyvod-iz-zapoya-rostov16.ru .

Профессиональный сервисный центр по ремонту электросамокатов в Москве.

Мы предлагаем: замена колеса на электросамокате

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

наркология вывод из запоя ростов наркология вывод из запоя ростов .

Профессиональный сервисный центр починить телефон профессиональный ремонт телефонов

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервис центры бытовой техники волгоград

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

как скачать Lucky Jet бесплатно https://raketa-igra.fun/

нарколог на дом в краснодаре нарколог на дом в краснодаре .

вызов нарколога цена вызов нарколога цена .

Все актуальные акции и предложения собраны на https://888starz-russia.online

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры по ремонту техники в воронеже

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр сервис по ремонту телефонов номер сдача телефона в ремонт

Профессиональный сервисный центр по ремонту моноблоков iMac в Москве.

Мы предлагаем: ремонт imac в москве на дому

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Выбирайте попутный груз из Новосибирска для оптимизации транспортных затрат https://vk.com/gruz_poputno

Подписывайтесь на @android_1xslots и скачайте APK для 1xSlots, активировав промокод LEGAL1X https://t.me/android_1xslots

Сервисный центр предлагает мастерские ремонта видеокарт biostar ремонт видеокарт biostar

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: цены на ремонт телефонов

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Профессиональный сервисный центр ремонт телефонов недорого ремонт телефон

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт бытовой техники в челябинске

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Рспользуйте РїСЂРѕРјРѕРєРѕРґ ANDROID777 для 7k Casino, скачав APK через официальный телеграм канал https://t.me/casino_7kk

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: сервисные центры в барнауле

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Начните массовую индексацию ссылок в Google прямо cейчас!

Быстрая индексация ссылок имеет ключевое значение для успеха вашего онлайн-бизнеса. Чем быстрее поисковые системы обнаружат и проиндексируют ваши ссылки, тем быстрее вы сможете привлечь новую аудиторию и повысить позиции вашего сайта в результатах поиска.

Не теряйте времени! Начните пользоваться нашим сервисом для ускоренной индексации внешних ссылок в Google и Yandex. Зарегистрируйтесь сегодня и получите первые результаты уже завтра. Ваш успех в ваших руках!

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: ремонт смартфонов в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Скачайте мобильное приложение 1xslots для Android и получите полный доступ к казино прямо с вашего смартфона в любое время.

Профессиональный сервисный центр сервис телефонов ремонты телефонов

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: ремонт ноутбука в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

купить диплом о высшем образовании образцы orik-diploms.ru .

https://martixart.com/10-luchshih-sajtov-dlja-skachivanija-besplatnyh-2/

Профессиональный сервисный центр по ремонту духовых шкафов в Москве.

Мы предлагаем: ремонт духовой шкаф электрический встраиваемый

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

купить диплом колледжа купить диплом колледжа .

Сервисный центр предлагает ремонт стиральной машины hisense в москве мастер по ремонту стиральной машины hisense

Всё, что нужно знать о покупке аттестата о среднем образовании

1win apk 1win apk .

Полезный сервис быстрого загона ссылок сайта в индексация поисковой системы – быстрая индексация ссылок

Как оказалось, купить диплом кандидата наук не так уж и сложно

golf.od.ua/forum/viewtopic.php?p=79949#79949

каталог франшиз каталог франшиз .

Пошаговая инструкция по безопасной покупке диплома о высшем образовании

prof-komplekt.com/club/log/index.php

купить диплом в санкт-петербурге arusak-diploms.ru .

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

вуз инфо дипломы отзывы вуз инфо дипломы отзывы .

Join the fun at CorgiSlots with free social slots and win exciting rewards with friends

Профессиональный сервисный центр по ремонту сотовых телефонов в Москве.

Мы предлагаем: срочный ремонт ноутбуков в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

купить технический диплом о среднем landik-diploms.ru .

Профессиональный сервисный центр по ремонту моноблоков iMac в Москве.

Мы предлагаем: внешний жесткий диск для imac

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

диплом о высшем образовании с занесением в реестр стоимость orik-diploms.ru .

если купить диплом если купить диплом .

Пошаговая инструкция по официальной покупке диплома о высшем образовании

купить диплом высшем новосибирск man-diploms.ru .

купить диплом госзнак server-diploms.ru .

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Полезная информация на сайте. Все что вы хоте знать об интернете полезный сервис

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Всё, что нужно знать о покупке аттестата о среднем образовании

laviehub.com/blog/kupit-diplom-689531clcw

охрана труда специальная оценка условий труда https://sout095.ru

ретро казино официальный сайт newretrocasino-casino3.ru .

Хочу поделиться своим опытом ремонта телефона в этом сервисном центре. Остался очень доволен качеством работы и скоростью обслуживания. Если ищете надёжное место для ремонта, обратитесь сюда: сколько стоит починить телефон.

Сертификация по ISO 9001 http://sertifikaciya-rf.ru позволяет не только упорядочить систему управления компанией и сделать ее более результативной, но и получить экономический эффект. Соответствующие исследования проводили испанские экономисты.

Free Music Search https://mp3get.net Find popular Songs and Download mp3

Игромания https://zhzh.info/publ/9-1-0-15167 или лудомания является одной из форм поведенческой зависимости, которая связана с участием в азартных играх.

Ландшафтная компания https://www.ilyamochalov.ru ландшафтный дизайн частных резиденций, гостиниц, жилых комплексов

диплом о высшем образовании с занесением в реестр диплом о высшем образовании с занесением в реестр .

Как быстро получить диплом магистра? Легальные способы

italian-style.ru/Nasha_kompanija/forum/?PAGE_NAME=profile_view&UID=60120

купить диплом о среднем образовании в спб prema-diploms.ru .

диплом специалиста server-diploms.ru .

Всё о покупке аттестата о среднем образовании: полезные советы

Диплом техникума купить официально с упрощенным обучением в Москве

Официальная покупка диплома вуза с упрощенной программой обучения

гознак аттестаты купить гознак аттестаты купить .

В ТД «Диамант» https://www.диамант-ростов.рф можно приобрести качественные полипропиленовые трубы, фитинги, трубы ПНД, трубы для внешней и внутренней канализации, а также соединительные элементы.

казино гамма гама зеркало

диплом купить недорого диплом купить недорого .

купить диплом о школьном образовании arusak-diploms.ru .

Сантехническая компания https://telegra.ph/Obzor-kompanii-San-Krasnodar-ot-riehltora-10-25 выполняет монтаж, ремонт и обслуживание систем водоснабжения, отопления и канализации. Специализация — установка труб, котлов, бойлеров, оперативное устранение аварий. Надёжность, качество, соблюдение сроков.

порно делан купить меф бесплатно

Сервисный центр предлагает ремонт электросамокатов cityroller в москве ремонт электросамоката cityroller в москве

можно ли купить диплом о высшем можно ли купить диплом о высшем .

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

Покупка школьного аттестата с упрощенной программой: что важно знать

Чтобы начать делать ставки на спорт, скачайте легальные БК и наслаждайтесь игрой прямо с телефона

Сколько стоит диплом высшего и среднего образования и как его получить?

laviehub.com/blog/kupit-diplom-488345mcbc

сервисный центр ремонт телефонов

Поиск проверенных дропов https://dropchik.ru с возможностью обналичивания и залогом. Все новости и актуальные предложения — надёжный ресурс для тех, кто ищет безопасные и выгодные условия.

Если вы искали где отремонтировать сломаную технику, обратите внимание – ремонт бытовой техники в екатеринбурге

Купить электронику https://electroshop-sam.ru по самым низким ценам!

Узнайте, как приобрести диплом о высшем образовании без рисков

Купить технику https://elektro-mag20.ru для дома!

Ремонт Квартир Алматы – ТОО “Ваш-Ремонт” помжет Вам от идеи до реализации. Надежно, качественно и в срок. Мы предлагаем полный спектр услуг: от дизайна интерьера до отделочных работ любой сложности. Доверьте свой ремонт опытным специалистам и получите идеальный результат.

Цена электроники https://elektro-msk777.ru для дома!

Онлайн купить https://elektrodus24.ru электронику для дома!

купить диплом олимпиады server-diploms.ru .

Можно ли купить аттестат о среднем образовании, основные моменты и вопросы

Полезные советы по безопасной покупке диплома о высшем образовании

обучение плаванию детей в москве тренер по плаванию обучение

Онлайн купить https://elektronika777.ru электронику для дома!

купить диплом парикмахера цена man-diploms.ru .

купить диплом за 10 11 класс landik-diploms.ru .

Реально ли приобрести диплом стоматолога? Основные этапы

Быстрая схема покупки диплома старого образца: что важно знать?

laviehub.com/blog/kupit-diplom-6977dbnh

Купить диплом РЎРЎРЎР

kyc-diplom.com/diplom-sssr.html

Ищете зеркало? Перейдите на 888Starz рабочее зеркало

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

moneysweet.listbb.ru/viewtopic.php?f=2&t=4774

Как официально приобрести аттестат 11 класса с минимальными затратами времени

forexrassia.ru/ofitsialnyiy-diplom-realizuyte-svoi-tseli-bez-lishnih-pregrad

купить высшее образование цена купить высшее образование цена .

Как приобрести аттестат о среднем образовании в Москве и других городах

Отзывы и рейтинг автосалонов https://edgo.ru ваш помощник в поиске надежного автодилера. Реальные отзывы клиентов и объективные рейтинги помогут вам выбрать автосалон, которому можно доверять. Удобный поиск и фильтры делают выбор простым и безопасным.

Get unlimited free instagram views generator simple platform to quickly increase the number of likes without risks

Registration at Vavada Casino thehiddentreasure2.com official website and working mirrors for today. Play at Vavada Casino online, get bonuses.

Betsafe Casino https://betsafe-1.com and sports betting opportunities. Register now and enjoy our slots, poker tournaments and the best odds on the market.

купить диплом в нижневартовске russa-diploms.ru .

Статьи и заметки о Windows https://windowsexpert.ru инструкции по настройке, советы по оптимизации, решения распространённых проблем и обзоры новых функций.

спб нарколог вывод из запоя спб нарколог вывод из запоя .

Быстрое обучение и получение диплома магистра – возможно ли это?

купить диплом учителя физкультуры arusak-diploms.ru .

Сколько стоит диплом высшего и среднего образования и как его получить?

Снижайте затраты на логистику с услугой попутного груза для маршрутов из Новосибирска

вывод из запоя цены санкт-петербург vyvod-iz-zapoya-v-sankt-peterburge16.ru .

спортивный диплом купить server-diploms.ru .

Как получить диплом стоматолога быстро и официально

Services ????????? for those who want to be one step ahead. We use effective tools – SEO, targeting, SMM – to attract customers and grow your brand. We increase recognition, optimize conversions and strengthen your position in the market!

полный спектр услуг реклама в армении для развития вашего бренда на армянском рынке. Мы создаем уникальные стратегии, адаптированные под местную аудиторию: от digital-маркетинга и SEO до наружной рекламы и PR-кампаний. Повышайте узнаваемость и привлекайте новых клиентов вместе с нами!

Купить диплом магистра оказалось возможно, быстрое обучение и диплом на руки

купить диплом высшее иваново man-diploms.ru .

купить диплом шымкент landik-diploms.ru .

Легальные способы покупки диплома о среднем полном образовании

Хотите безопасный доступ? Просто 888starz скачать на айфон

купить диплом медицинского вуза купить диплом медицинского вуза .

Как приобрести диплом техникума с минимальными рисками

Легальная покупка диплома ПТУ с сокращенной программой обучения

Возможно ли купить диплом стоматолога, и как это происходит

купить аттестат в твери купить аттестат в твери .

купить диплом готовый купить диплом готовый .

Сколько стоит диплом высшего и среднего образования и как его получить?

Для увеличения позиций сайта подойдёт курс накрутки ПФ, ориентированный на оптимизацию.

Как получить диплом техникума с упрощенным обучением в Москве официально

купить диплом в челябинске с занесением man-diploms.ru .

Реально ли приобрести диплом стоматолога? Основные шаги

openmotonews.ru/gotovyiy-diplom-dlya-teh-kto-hochet-bolshego

Где и как купить диплом о высшем образовании без лишних рисков

zarea.flybb.ru/viewtopic.php?f=2&t=410

купить диплом 1999 года выпуска diplomdarom.ru .

Explorez notre collection de

Nos marques

a ajouter a votre arsenal culinaire

где купить готовый диплом russa-diploms.ru .

Free scanner https://theqrcode.site for QR Codes without app. QR codes from camera, image, picture, screenshot or webcam. Scan Wifi QR Online without app and get network name, password.

рабочие промокоды реал дроп промо обновления ежедневно, только рабочие коды.

купить диплом маляра orik-diploms.ru .

Полезная информация как купить диплом о высшем образовании без рисков

заказать продвижение сайта в топ https://is-market.ru

продвижение сайтов агентство https://is-market.ru

Как не попасть впросак при покупке диплома колледжа или ПТУ в России

купить диплом в череповце arusak-diploms.ru .

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

купить диплом о высшем образовании в липецке server-diploms.ru .

Бесплатные приложения https://appdiscover.ru и игры для Андроид, заходии и скачивай на русском языке.

купить диплом 2023 года man-diploms.ru .

купить диплом в ульяновске diplomdarom.ru .

Попутный груз Новосибирск — это ваш способ сократить затраты на доставку по нужным направлениям.

Как быстро получить диплом магистра? Легальные способы

Купить мебель https://www.premiere-mebel.ru для стильного интерьера. Широкий ассортимент, высокое качество и продуманный дизайн для вашего дома и офиса.

Профессиональный массаж для расслабления и восстановления. Различные техники: классический, спортивный, лечебный и релакс. Помогаем снять стресс, улучшить самочувствие и зарядиться энергией. Комфортная обстановка и индивидуальный подход к каждому клиенту.

Pretty component to content. I simply stumbled upon your website and in accession capital to assert that I acquire actually loved account your blog posts. Anyway I’ll be subscribing for your feeds and even I fulfillment you get entry to constantly quickly.

накрутка пф заказать

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Отказное письмо https://abb-nsk.ru документ, который выдаётся аккредитованными органами по сертификации на продукцию, не требующую обязательной сертификации. Этот документ получают для облегчения прохождения таможенного контроля. Если при прохождении возникнет вопрос: почему на товар отсутствует сертификат, этот документ будет полезен, так как в нём содержится ответ официального сертифицирующего органа.

Получать сертификат ГОСТ Р ИСО 9001:2015 https://bureaupk.ru нужно в органе по сертификации, аккредитованном федеральным органом исполнительной власти. Согласно Постановлению Правительства по Указу Президента РФ эти функции возложены на Росаккредитацию. Выданный документ должен быть зарегистрирован в реестре, что позволяет проверить его подлинность.

Купить диплом магистра оказалось возможно, быстрое обучение и диплом на руки

all-smeta.ru/?sid=df1524417cd591bb1feab55417401d94

Официальная покупка диплома вуза с сокращенной программой обучения в Москве

Профессиональный массаж Ивантеевка для расслабления, снятия стресса и улучшения самочувствия. Опытный мастер, индивидуальный подход, уютная атмосфера. Забота о вашем здоровье и комфорте!

рулонный газон под ключ цена ландшафтный проект

Как безопасно купить диплом колледжа или ПТУ в России, что важно знать

Мы предлагаем рецепты https://muchato.ru которые помогут воплотить в жизнь ваши кулинарные фантазии и желания. Благодаря собранным по всей Италии рецептам, вы сможете не только научиться готовить вкусные блюда, но и создавать уникальные рецепты, которые будут восхищать вас и ваших близких.

купить диплом о высшем образовании в рязани купить диплом о высшем образовании в рязани .

Легальная покупка диплома ПТУ с сокращенной программой обучения

купить диплом в ижевске prema365-diploms.ru .

homes in kotor realty Montenegro

Лучшие порно видео Гей порно Бонсай скачать бесплатно без регистрации и смс. Смотреть порно онлайн в высоком качестве.

bar polje Montenegro property sales

Оформляем пропуск в москву быстрое получение пропусков на въезд в МКАД, ТТК, СК. Оперативное решение всех вопросов, минимизация простоев, доступные цены.

Качественные услуги массаж Ивантеевка для полного восстановления и релакса. Лечебный, спортивный и расслабляющий массаж от профессионалов. Повышение тонуса и снятие напряжения в комфортной обстановке.

Alto Consulting Group (ACG) https://alto-group.ru предлагает комплексные маркетинговые исследования рынков в России и за рубежом. Наша команда проводит детализированные обзоры рынков, анализирует экспорт и импорт по кодам ТНВЭД, а также изучает государственные и коммерческие закупки по 44-ФЗ и 223-ФЗ.

Скачать игры для Андроид https://igryforandroid.ru бесплатно и на русском языке, доступны новинки и популярные приложения.

Буквы бюстгальтеров Бюстгальтеры для свадьбы

смартфон apple iphone 15 купить apple iphone 15 pro max

can foreigners buy property in Montenegro apartments for sale Budva

Тут можно преобрести купить сейф для охотничьего карабина где купить сейф для оружия

1xslots скачать бесплатно на андроид — это лучший способ получить доступ к казино.

Официальная покупка диплома вуза с сокращенной программой в Москве

оценка факторов условий труда https://sout095.ru

Как получить диплом техникума с упрощенным обучением в Москве официально

Займ 50 000 тенге Sravnim.kz

компании специальная оценка условий труда проверка соут

Покупка диплома о среднем полном образовании: как избежать мошенничества?

купить диплом о высшем образовании с занесением в реестр в красноярске купить диплом о высшем образовании с занесением в реестр в красноярске .

купить диплом в туапсе many-diplom77.ru .

Парадокс, но купить диплом кандидата наук оказалось не так и сложно

прокат сноубордов красная Красная Поляна https://prokat-lyzh-krasnaya-polyana.ru

купить диплом рхту prema365-diploms.ru .

Всё о покупке аттестата о среднем образовании: полезные советы

Перед началом игры изучите игра ракета отзывы и узнайте об опыте игроков.

Купить диплом о среднем образовании в Москве и любом другом городе

промокод на подключение модуля Getcourse Pay http://www.platezhnyj-modul-getkurs-promokod.ru .

прокат лыж красная поляна цены 2024 пункт проката сноубордов Красная Поляна

Как купить диплом о высшем образовании с минимальными рисками

39504.org/showthread.php?tid=35638

Диплом техникума купить официально с упрощенным обучением в Москве

Сколько стоит диплом высшего и среднего образования и как это происходит?

Как приобрести диплом о среднем образовании в Москве и других городах

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Чтобы получить доступ к ставкам на спорт, скачайте приложение БК на телефон

Right here is the perfect webpage for anyone who really wants to find out about this topic. You know a whole lot its almost hard to argue with you (not that I really will need to…HaHa). You certainly put a fresh spin on a subject that’s been discussed for decades. Excellent stuff, just great!

вход вега казино

Где и как купить диплом о высшем образовании без лишних рисков

Hello Dear, are you truly visiting this site daily, if so afterward you will absolutely get good know-how.

сайт банда казино

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

купить дипломы техникума цена москва купить дипломы техникума цена москва .

Тут можно преобрести сейф огнеупорный сейф несгораемый купить

промокод на подключение продамуса https://prodamus-promokod1.ru .

Как получить диплом техникума с упрощенным обучением в Москве официально

Официальная покупка школьного аттестата с упрощенным обучением в Москве

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Для тех, кто любит азарт, Лаки джет ракета — идеальный выбор.

Официальная покупка школьного аттестата с упрощенным обучением в Москве

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

кто должен проводить соут процедура проведения соут

купить диплом вуз купить диплом вуз .

Всё, что нужно знать о покупке аттестата о среднем образовании

Enjoyed reading this, very good stuff, regards.

Легальная покупка диплома о среднем образовании в Москве и регионах

Приобретение школьного аттестата с официальным упрощенным обучением в Москве

Полезные советы по безопасной покупке диплома о высшем образовании

wo.linyway.com/read-blog/27703

Узнайте стоимость диплома высшего и среднего образования и процесс получения

Download 888Starz Pakistan for premium casino and sports betting.

Официальная покупка диплома ПТУ с упрощенной программой обучения

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

Enjoy unique gaming rewards with 888Starz bonus codes and maximize your experience.

Как оказалось, купить диплом кандидата наук не так уж и сложно

Покупка диплома о среднем полном образовании: как избежать мошенничества?

купить диплом о неполном образовании купить диплом о неполном образовании .

Стоимость дипломов высшего и среднего образования и процесс их получения

Узнайте, как безопасно купить диплом о высшем образовании

Официальное получение диплома техникума с упрощенным обучением в Москве

Узнайте, как приобрести диплом о высшем образовании без рисков

Купить диплом о среднем полном образовании, в чем подвох и как избежать обмана?

Реально ли приобрести диплом стоматолога? Основные шаги

Купить смартфон https://elektronik-art.ru по низкой цене с быстрой доставкой!

Descarga la 1xslots apk y lleva el casino contigo en tu movil.

Вопросы и ответы: можно ли быстро купить диплом старого образца?

Легальные способы покупки диплома о среднем полном образовании

Пошаговая инструкция по официальной покупке диплома о высшем образовании

Как получить диплом техникума с упрощенным обучением в Москве официально

Узнайте, как безопасно купить диплом о высшем образовании

vseogirls.ru/diplom-v-szhatyie-sroki-shag-k-uspehu-bez-zaderzhek

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

охрана труда дистанционное обучение курсы москва курсы по охране труда дистанционное обучение в москве

Купить диплом о среднем образовании в Москве и любом другом городе

Полезная информация как купить диплом о высшем образовании без рисков

Покупка диплома о среднем полном образовании: как избежать мошенничества?

закачать приложения казино https://teatroabrescia.it/2024/11/prodvizhenie-mobilnyh-prilozhenij-raskrutka

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

продамус промокод скидка на подключение продамус промокод скидка на подключение .

Можно ли купить аттестат о среднем образовании, основные моменты и вопросы

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Быстрая схема покупки диплома старого образца: что важно знать?

Всё, что нужно знать о покупке аттестата о среднем образовании без рисков

Как приобрести аттестат о среднем образовании в Москве и других городах

Аттестат 11 класса купить официально с упрощенным обучением в Москве

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Как официально купить диплом вуза с упрощенным обучением в Москве

Полезная информация как официально купить диплом о высшем образовании

Полезная информация как купить диплом о высшем образовании без рисков

Как купить аттестат 11 класса с официальным упрощенным обучением в Москве

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали официальный сервисный центр philips, можете посмотреть на сайте: сервисный центр philips в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали сервисный центр philips в москве, можете посмотреть на сайте: сервисный центр philips в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали официальный сервисный центр philips, можете посмотреть на сайте: сервисный центр philips

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Официальная покупка диплома вуза с сокращенной программой обучения в Москве

проведение соут цена https://sout213.ru

Ремонт квартир https://remont-kv-moskva.ru недорого, ремонт от профи!

аккредитованные организации соут в москве охрана труда специальная оценка условий труда в москве

Оформление медицинских справок https://spravkanam777.ru быстро!

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Федерация – это проводник в мир покупки запрещенных товаров, можно купить альфа пвп, купить кокаин, купить меф, купить экстази в различных городах. Москва, Санкт-Петербург, Краснодар, Владивосток, Красноярск, Норильск, Екатеринбург, Мск, СПБ, Хабаровск, Новосибирск, Казань и еще 100+ городов.

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали сервисный центр asus, можете посмотреть на сайте: сервисный центр asus рядом

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали сервисный центр asus, можете посмотреть на сайте: сервисный центр asus цены

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Предлагаем услуги профессиональных инженеров офицальной мастерской.

Еслли вы искали сервисный центр asus в москве, можете посмотреть на сайте: сервисный центр asus

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Сколько стоит диплом высшего и среднего образования и как его получить?

Оформление медицинских справок https://spravkukupit-vsem.ru/ без проблем!

Оформление медицинских справок https://electronikson.ru без проблем!

Диплом вуза купить официально с упрощенным обучением в Москве

Скачайте приложение Mostbet Casino для удобной игры | Mostbet min kod дает дополнительные преимущества | Mostbet shaxsiy kabinet – это ваш личный центр управления ставками | Mostbet oyinlari baxtingizni sinab ko’rishga imkon beradi | Mostbet официальный сайт предлагает множество акций мост бет. | Скачайте Mostbet приложение и наслаждайтесь игрой | Mostbet min kod – это дополнительные привилегии для игроков | Mostbet официальный сайт – это удобный интерфейс и поддержка | Mostbet uz online – это ваш лучший выбор для игр и ставок Mostbet apk.

Mostbet Kirish – вход на лучший игровой портал в Узбекистане | Ройхатдан ўтиш на сайте Mostbet Uz максимально простой | Mostbet oyinlari – это развлечения мирового уровня | Mostbet oyinlari baxtingizni sinab ko’rishga imkon beradi | Mostbet casino – это увлекательные игры и быстрые выплаты mostbetcasinouzkirishgderf.com. | Mostbet min az – ваш надежный игровой портал | Mostbet uz 34 – лучший портал для ставок в Узбекистане | Mostbet регистрация дает уникальные привилегии для новых игроков | Mostbet uz online – это ваш лучший выбор для игр и ставок Mostbet uz online.

Собственное производство металлоконструкций. Если вас интересует навес для одной машины стоимость мы предлогаем изготовление под ключ Навесы во Всеволожске

Современные тактичные штаны: выбор успешных мужчин, как сочетать их с другой одеждой.

Тактичные штаны: удобство и функциональность, которые подчеркнут ваш стиль и индивидуальность.

Идеальные тактичные штаны: находка для занятых людей, который подчеркнет вашу уверенность и статус.

Тактичные штаны для активного отдыха: важный элемент гардероба, которые подчеркнут вашу спортивную натуру.

Советы по выбору тактичных штанов для мужчин, чтобы подчеркнуть свою уникальность и индивидуальность.

История появления тактичных штанов, которые подчеркнут ваш вкус и качество вашей одежды.

Тактичные штаны: универсальный выбор для различных ситуаций, которые подчеркнут ваш профессионализм и серьезность.

штани тактичні зсу https://dffrgrgrgdhajshf.com.ua/ .

Парадокс, но купить диплом кандидата наук оказалось не так и сложно

загрузить приложения онлайн казино http://cg.akylabo.com/oficialnyj-sajt-onlajn-igry-i-kazino-obzor-bonusy-7/

Наши специалисты предлагает профессиональный отремонтировать кондиционер рядом всех типов и брендов. Мы осознаем, насколько значимы для вас ваши сплит-системы, и стремимся предоставить услуги наилучшего качества. Наши опытные мастера работают быстро и аккуратно, используя только сертифицированные компоненты, что обеспечивает долговечность и надежность наших услуг.

Наиболее частые неисправности, с которыми сталкиваются пользователи сплит-систем, включают проблемы с охлаждением, неработающий вентилятор, неисправности программного обеспечения, неисправности датчиков и механические повреждения. Для устранения этих поломок наши профессиональные техники оказывают ремонт компрессоров, вентиляторов, ПО, датчиков и механических компонентов. Доверив ремонт нам, вы гарантируете себе долговечный и надежный центр ремонта кондиционера.

Подробная информация представлена на нашем сайте: https://remont-kondicionerov-wow.ru

вавада фриспины предоставляет уникальную возможность погрузиться в мир азартных игр. здесь вы сможете войти в систему на официальном сайте vavada. получите доступ к бонусам через личный кабинет.

Тут можно преобрести сейфы офисные взломостойкие взломостойкие сейфы для дома

Как купить диплом о высшем образовании с минимальными рисками

Reliable HVAC Repair Services https://serviceorangecounty.com stay comfortable year-round with our professional HVAC repair services. Our experienced team is dedicated to diagnosing and resolving heating, cooling, and ventilation issues quickly and effectively.

Reliable HVAC Repair Services https://serviceorangecounty.com stay comfortable year-round with our professional HVAC repair services. Our experienced team is dedicated to diagnosing and resolving heating, cooling, and ventilation issues quickly and effectively.

Reliable HVAC Repair Services https://serviceorangecounty.com stay comfortable year-round with our professional HVAC repair services. Our experienced team is dedicated to diagnosing and resolving heating, cooling, and ventilation issues quickly and effectively.

Наша мастерская предлагает надежный ремонт кофемашин адреса любых брендов и моделей. Мы понимаем, насколько значимы для вас ваши кофеварки, и готовы предложить сервис высочайшего уровня. Наши квалифицированные специалисты проводят ремонтные работы с высокой скоростью и точностью, используя только сертифицированные компоненты, что обеспечивает длительную работу проведенных ремонтов.

Наиболее частые неисправности, с которыми сталкиваются владельцы кофемашин, включают проблемы с температурными датчиками, проблемы с подачей воды, неисправности программного обеспечения, неработающие разъемы и повреждения корпуса. Для устранения этих поломок наши опытные мастера проводят ремонт нагревательных элементов, насосов, ПО, разъемов и механических компонентов. Обращаясь в наш сервисный центр, вы обеспечиваете себе долговечный и надежный ремонт кофемашина с гарантией.

Подробная информация размещена на сайте: https://remont-kofemashin-top.ru

Наша мастерская предлагает высококачественный ремонт массажного кресла на выезде любых брендов и моделей. Мы осознаем, насколько значимы для вас ваши массажные кресла, и готовы предложить сервис наилучшего качества. Наши опытные мастера работают быстро и аккуратно, используя только качественные детали, что предоставляет долговечность и надежность выполненных работ.

Наиболее распространенные поломки, с которыми сталкиваются пользователи релаксационных кресел, включают неработающий мотор, неисправности роликов, неисправности программного обеспечения, неисправности разъемов и поломки компонентов. Для устранения этих поломок наши профессиональные техники выполняют ремонт моторов, роликов, ПО, разъемов и механических компонентов. Доверив ремонт нам, вы гарантируете себе надежный и долговечный починить массажное кресло в москве.

Подробная информация размещена на сайте: https://remont-massazhnyh-kresel-gold.ru

Наши специалисты предлагает профессиональный сервисный центр по ремонту майнера различных марок и моделей. Мы понимаем, насколько важны для вас ваши майнеры, и обеспечиваем ремонт высочайшего уровня. Наши опытные мастера оперативно и тщательно выполняют работу, используя только оригинальные запчасти, что предоставляет долговечность и надежность проведенных ремонтов.

Наиболее распространенные поломки, с которыми сталкиваются обладатели криптомайнеров, включают перегрев, неработающий блок питания, ошибки ПО, неработающие разъемы и неисправности оборудования. Для устранения этих поломок наши опытные мастера проводят ремонт систем охлаждения, блоков питания, ПО, разъемов и оборудования. Обращаясь в наш сервисный центр, вы гарантируете себе надежный и долговечный сервисный ремонт майнеров адреса.

Подробная информация размещена на сайте: https://remont-maynerov-geek.ru

Наша мастерская предлагает профессиональный сервис ремонта монитора на дому различных марок и моделей. Мы знаем, насколько необходимы вам ваши экраны, и стремимся предоставить услуги высочайшего уровня. Наши квалифицированные специалисты оперативно и тщательно выполняют работу, используя только сертифицированные компоненты, что обеспечивает длительную работу наших услуг.

Наиболее общие проблемы, с которыми сталкиваются пользователи дисплеев, включают неработающую подсветку, неисправности матрицы, ошибки ПО, неисправности разъемов и механические повреждения. Для устранения этих проблем наши квалифицированные специалисты оказывают ремонт подсветки, матриц, ПО, разъемов и механических компонентов. Доверив ремонт нам, вы гарантируете себе долговечный и надежный центр ремонта мониторов с гарантией.

Подробная информация размещена на сайте: https://remont-monitorov-plus.ru

Наша мастерская предлагает высококачественный сервисный ремонт моноблока на выезде всех типов и брендов. Мы знаем, насколько значимы для вас ваши все-в-одном ПК, и стремимся предоставить услуги первоклассного уровня. Наши профессиональные техники работают быстро и аккуратно, используя только сертифицированные компоненты, что гарантирует долговечность и надежность проведенных ремонтов.

Наиболее распространенные поломки, с которыми сталкиваются обладатели моноблочных компьютеров, включают неисправности HDD, проблемы с экраном, неисправности программного обеспечения, неисправности разъемов и неисправности системы охлаждения. Для устранения этих неисправностей наши профессиональные техники выполняют ремонт жестких дисков, дисплеев, ПО, разъемов и систем охлаждения. Доверив ремонт нам, вы обеспечиваете себе качественный и надежный мастерская по ремонту моноблоков адреса.

Подробная информация представлена на нашем сайте: https://remont-monoblokov-rial.ru

Для игры на iPhone используйте 1xslots на айфон.

Find out how to become a successful realtor in Indiana | The quickest way to become a licensed real estate agent in Indiana | Maximize your potential with an Indiana real estate license state of Indiana real estate license | Achieve financial freedom with an Indiana real estate license | Unlock your future with a realtor license in Indiana | Indiana real estate license – your first step to success | Secure your place in the market with Indiana real estate certification | Indiana real estate license application steps outlined clearly | Build a strong foundation with Indiana real estate licensing indianarealestatelicensecom.

Наши специалисты предлагает высококачественный сервисный ремонт моноколеса любых брендов и моделей. Мы осознаем, насколько значимы для вас ваши электрические моноколеса, и готовы предложить сервис наилучшего качества. Наши профессиональные техники работают быстро и аккуратно, используя только качественные детали, что гарантирует надежность и долговечность выполненных работ.

Наиболее распространенные поломки, с которыми сталкиваются обладатели самобалансирующихся устройств, включают неисправную батарею, неисправности двигателя, неисправный контроллер, проблемы с гиросенсорами и поломки корпуса. Для устранения этих неисправностей наши квалифицированные специалисты проводят ремонт батарей, двигателей, контроллеров, гиросенсоров и механических компонентов. Обращаясь в наш сервисный центр, вы обеспечиваете себе долговечный и надежный сервисный центр по ремонту моноколеса на дому.

Подробная информация представлена на нашем сайте: https://remont-monokoles-serv.ru

Как официально купить аттестат 11 класса с упрощенным обучением в Москве

Покупка диплома о среднем полном образовании: как избежать мошенничества?

Find out how to pass the Ohio real estate exam | Start a new career with an Ohio real estate license | Discover how to get your Ohio real estate license today | Affordable options for Ohio real estate license courses | Ohio real estate market insights for aspiring agents | Affordable ways to obtain your Ohio real estate license realtor license Ohio ssousaorg | Professional growth with an Ohio realtor license | Start your journey as a certified real estate agent in Ohio | Learn how to navigate the Ohio real estate licensing system Ohio real estate license application.

Подробная информация об 1xSlots https://aztarna.es/pages/1xslots-casino_15.html

Попробуйте удачу с бесплатными вращениями — активируйте 1xslots фриспины прямо сейчас.

МТЮ Лизинг https://depo.rent предоставляет аренду автомобилей в Крыму, включая Симферополь. Удобный онлайн-сервис позволяет оформить аренду на сайте за несколько минут. Широкий выбор автомобилей и выгодные условия делают поездки по региону комфортными и доступными.

soap2day premieres soap2day movies hd

Наш сервисный центр предлагает надежный починить айфон с гарантией всех типов и брендов. Мы знаем, насколько важны для вас ваши смартфоны Apple, и обеспечиваем ремонт первоклассного уровня. Наши профессиональные техники проводят ремонтные работы с высокой скоростью и точностью, используя только сертифицированные компоненты, что предоставляет надежность и долговечность наших услуг.

Наиболее распространенные поломки, с которыми сталкиваются владельцы iPhone, включают проблемы с экраном, поломку батареи, неисправности программного обеспечения, проблемы с портами и поломки корпуса. Для устранения этих поломок наши опытные мастера выполняют ремонт экранов, батарей, ПО, разъемов и механических компонентов. Доверив ремонт нам, вы гарантируете себе надежный и долговечный мастерская по ремонту iphone.

Подробная информация размещена на сайте: https://remont-iphone-sot.ru

промокод продамус https://www.promokod-prod.ru .

Наш сервисный центр предлагает высококачественный отремонтировать айфон рядом любых брендов и моделей. Мы понимаем, насколько важны для вас ваши смартфоны Apple, и стремимся предоставить услуги первоклассного уровня. Наши квалифицированные специалисты работают быстро и аккуратно, используя только оригинальные запчасти, что гарантирует длительную работу выполненных работ.

Наиболее общие проблемы, с которыми сталкиваются обладатели устройств iPhone, включают поврежденный экран, поломку батареи, неисправности программного обеспечения, проблемы с портами и повреждения корпуса. Для устранения этих неисправностей наши квалифицированные специалисты оказывают ремонт экранов, батарей, ПО, разъемов и механических компонентов. Обращаясь в наш сервисный центр, вы обеспечиваете себе надежный и долговечный сервисный ремонт iphone с гарантией.

Подробная информация доступна на сайте: https://remont-iphone-sot.ru

Find out how to pass the Ohio real estate exam | Ohio real estate license application process made simple | Real estate licensing in Ohio simplified for beginners | How to get certified as a real estate agent in Ohio | Everything you need to know about Ohio real estate licenses | Top resources for Ohio real estate license preparation Ohio real estate exam | Take advantage of Ohio’s real estate license opportunities | Find helpful tips for passing the Ohio state real estate test | Secure your future with a realtor license in Ohio real estate license Ohio.

This excellent website definitely has all of the info I needed about this subject and didn’t know who to ask.

livechat rgo303

Узнай, как работает 1xSlots https://aztarna.es/pages/1xslots-casino_15.html

двери межкомнатные купить входную дверь

Наши специалисты предлагает надежный ремонт макбука в москве всех типов и брендов. Мы осознаем, насколько важны для вас ваши ноутбуки Apple, и стремимся предоставить услуги высочайшего уровня. Наши опытные мастера проводят ремонтные работы с высокой скоростью и точностью, используя только качественные детали, что гарантирует надежность и долговечность выполненных работ.

Наиболее частые неисправности, с которыми сталкиваются владельцы MacBook, включают проблемы с экраном, проблемы с батареей, ошибки ПО, проблемы с портами и неисправности системы охлаждения. Для устранения этих неисправностей наши профессиональные техники оказывают ремонт экранов, батарей, ПО, разъемов и систем охлаждения. Обратившись к нам, вы обеспечиваете себе качественный и надежный мастерская по ремонту macbook на дому.

Подробная информация доступна на сайте: https://remont-macbook-club.ru

Можно ли быстро купить диплом старого образца и в чем подвох?

магазин аккумуляторы в петербурге магазин аккумуляторы в петербурге

межевание спб кадастровый инженер

газовый генератор 50 квт цена https://tss-generators.ru

Наши специалисты предлагает профессиональный сервис ремонта варочных панелей всех типов и брендов. Мы осознаем, насколько необходимы вам ваши плиты, и готовы предложить сервис наилучшего качества. Наши опытные мастера оперативно и тщательно выполняют работу, используя только оригинальные запчасти, что предоставляет длительную работу наших услуг.

Наиболее распространенные поломки, с которыми сталкиваются обладатели кухонных поверхностей, включают неисправности нагревательных элементов, неисправности сенсоров, неисправности программного обеспечения, неисправности разъемов и повреждения корпуса. Для устранения этих поломок наши профессиональные техники оказывают ремонт нагревательных элементов, сенсоров, ПО, разъемов и механических компонентов. Доверив ремонт нам, вы гарантируете себе долговечный и надежный ремонт варочной панели рядом.

Подробная информация представлена на нашем сайте: https://remont-varochnyh-paneley-hit.ru

Plinko se ha convertido https://medium.com/@kostumchik.kiev.ua/todo-sobre-el-juego-de-plinko-en-m%C3%A9xico-instrucciones-demos-opiniones-y-m%C3%A1s-d1fde2d99338 en una de las opciones favoritas de los jugadores de casinos en Mexico. Conocido por su simplicidad y gran potencial de ganancias, este adictivo juego ahora cuenta con una plataforma oficial en Mexico.

Онлайн-журнал о строительстве https://zip.org.ua практичные советы, современные технологии, тренды дизайна и архитектуры. Всё о строительных материалах, ремонте, благоустройстве и инновациях в одной удобной платформе.

лучшие онлайн казино рейтинг онлайн казино

Официальная покупка школьного аттестата с упрощенным обучением в Москве

секс шоп https://sex-shop-kh.top

Познакомься с 1xSlots https://santaeugenia.archimadrid.es/pags/1xslots-casino-argentina_1.html

Тут можно сейфы офисные огнестойкиекупить сейф для офиса в москве

Наша мастерская предлагает высококачественный официальный ремонт видеокамеры адреса всех типов и брендов. Мы понимаем, насколько необходимы вам ваши видеорегистраторы, и готовы предложить сервис первоклассного уровня. Наши опытные мастера оперативно и тщательно выполняют работу, используя только сертифицированные компоненты, что гарантирует долговечность и надежность наших услуг.